Excel is a powerful tool for business. It can be used in many ways to create spreadsheets, charts, graphs, and other data presentations. It is a digital tool for business owners, and it helps them make their work easier and effective.

A spreadsheet is a digital tool that is primarily used for financial data. This allows business owners to track everything like inventory, sales, payroll, and more. It helps them manage their finances and make better decisions when it comes to planning for the future.

The most crucial benefit of using Excel is that it’s easy to use. Business owners can easily access their financial information through this tool, which they can use to analyze trends to improve their business in the future. Here are more uses of Excel for business owners.

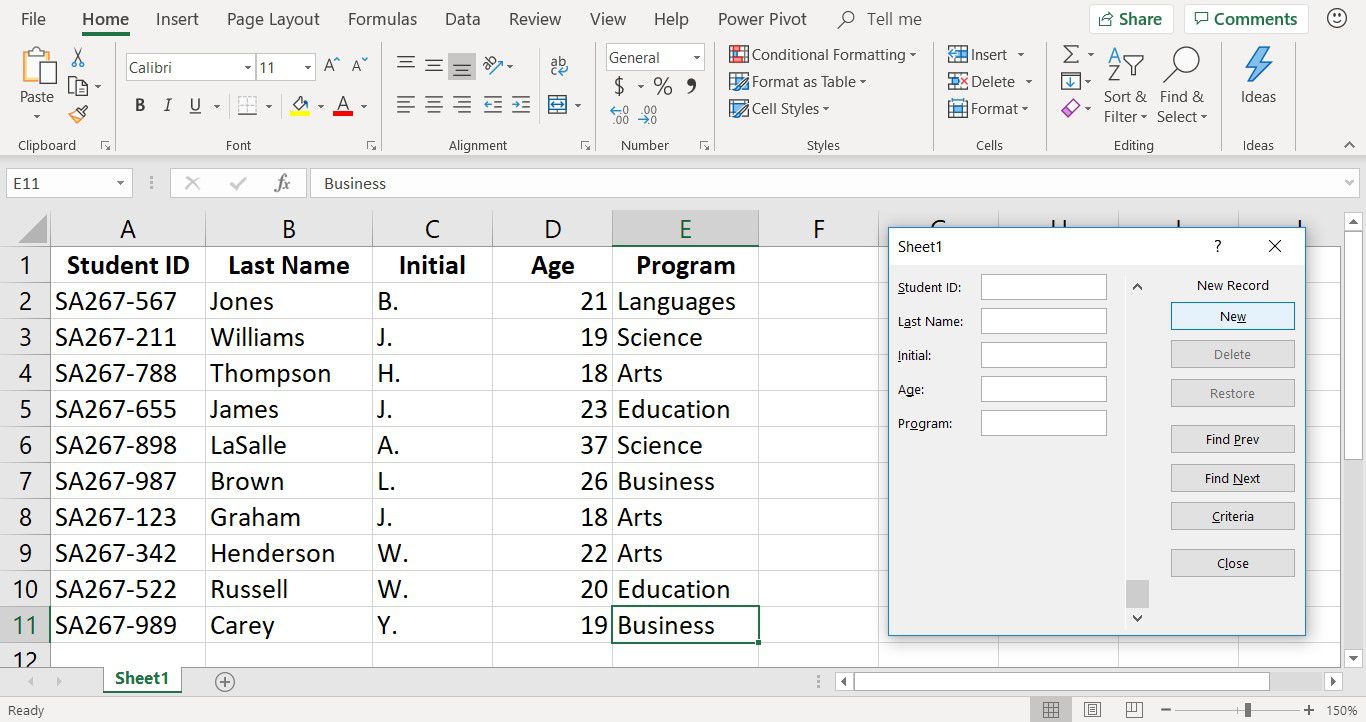

1. Storage and Data Entry

Excel is a spreadsheet tool that lets users organize data in different ways to help them make sense of it. Excel is arguably the most popular software for data entry. It has an extensive library of functions and tricks to make it easier to organize, calculate, and visualize data. The software is used across the business industry because it’s easy-to-use, powerful, and versatile. It’s one of the most popular office tools used by both IT professionals and business people looking to do their calculations quickly without having to resort to pen-and-paper or other manual equations.

To store Excel for the long term, you need to convert it to other file formats like PDF. With GogoPDF, you can easily convert files from Excel to PDF online. You wouldn’t need to download additional software as GogoPDF can be accessed through the web using your browser. All you have to do is upload your Excel file, wait for the conversion, then your document is ready to be downloaded.

Excel is one of the most widely used Microsoft Office products in the world. It is a spreadsheet application that provides users with an easy way to store, organize, and manipulate data. It can be used for storing current financial or business data that are constantly changing. It also comes in handy for managing large data sets when it’s easier to use Excel than manually enter them into a spreadsheet program.

Excel is an indispensable tool in the modern workplace because it allows you to save practically any type of data so that you can easily access it later on without having to fill up your hard drive with paper sheets of information.

2. Accounting and Budgeting

Excel is one of the most popular spreadsheet-based applications in use today. It can be used for all purposes, including accounting and budgeting and creating spreadsheets for businesses to manage their finances.

Excel can be used to calculate finances in business with ease. There are a lot of Excel tools that help create and manage financial reports and forecasts. This is especially helpful for small and medium-sized businesses that may not have the time or resources to track their financials.

Using excel to calculate finances in business has significant benefits that cannot be achieved by any other means, including cost-effective management, scalability, and ease of use.

Some businesses use it to manage finances, but its true power lies in its ability to generate and analyze data. The use of Excel spreadsheets in business has increased significantly over the past years. It has become an essential tool for managers and executives at all levels.

3. Data Analysis

Excel is a spreadsheet program that data analysts and business professionals have used for over 30 years. It is an easy-to-use and versatile tool, which can be used in a variety of scenarios. You can also use Excel to analyze data and create pivot tables.

Pivot tables are one of the essential tools in Excel because they enable users to generate reports easily and calculate numerical values from different rows and columns in the data set. Pivot tables are an excellent example of how business professionals in different contexts use Excel. This can be used to create an income report for the company or just as a cheat sheet for yourself at home for personal use.

Excel is a very flexible tool that can be used for data analysis. It is an effective and efficient data reporting tool because it allows you to organize, manipulate, and filter your data quickly. They are also commonly used in finance, management consulting, and online marketing. Excel is sometimes preferred over other platforms because it’s so flexible, which helps the analyst maximize their time to output results.

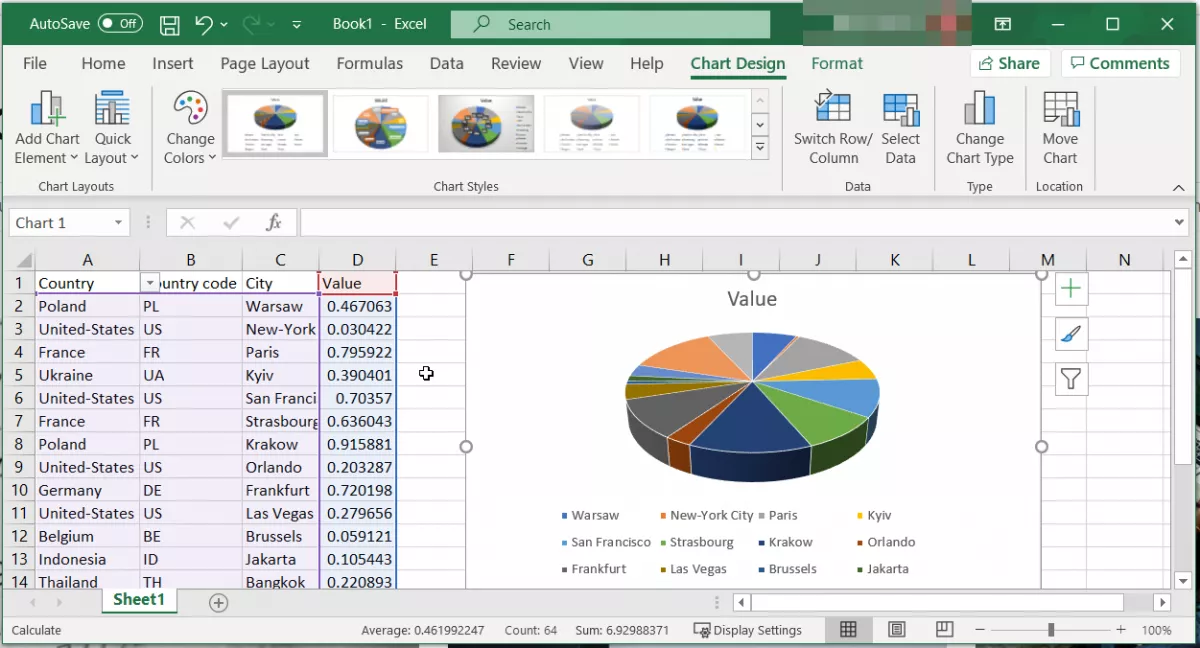

4. Reporting and Visualization

Excel for reports can be used to do some simple things like creating graphs and charts. With the latest spreadsheet version, Excel now has built-in tools that let you analyze your data with graphs and charts.

With the help of these new features, Excel allows users to access graphs faster than ever before. This can reduce your workload as well as provide high-quality reports in just a few clicks.

Excel is now more than just a spreadsheet. It now can create reports that utilize graphs and charts with different colors and effects, further making the information easier to understand and can be used to communicate information more effectively than ever before.

Conclusion

To say that Excel has benefits would be an understatement because it also helps businesses save money because of its low cost of ownership compared to other digital tools like accounting software or project management software.

Many businesses depend on Excel because it allows them to manage things like sales figures and budgets efficiently. Though the pros of Excel outweigh the cons, it still has a few limitations. One of them is that it can be difficult to use Excel if you are unfamiliar with the program.

It takes time and effort to learn Excel and become proficient with it. However, it can be worth the time and effort because Excel provides businesses’ tools to run their operations effectively. The most common business applications of Excel are data analysis, financial analysis, and cost tracking.